b&o tax form

Handy tips for filling out Lacey b o tax form online. BO Tax Returns must be filed quarterly.

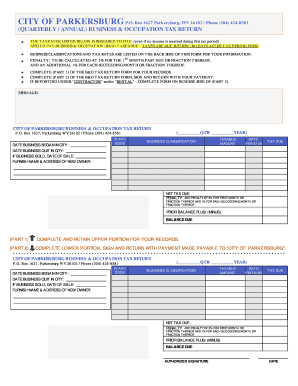

Fillable Online B O Tax Standard Form City Of Parkersburg Fax Email Print Pdffiller

Job Credits - You can receive a 500 BO tax credit every year for five if you.

. File and pay BO taxes. The City assesses a business and occupation BO tax of 01 one tenth of one percent on businesses with gross receipts in excess of 200000. Determine your Business Classifications and corresponding rates from the tax table.

Business Occupation BO Tax. Minimum penalty on all late returns where tax is due is 500. The state BO tax is a gross receipts tax.

Mail or deliver completed Tax Return to. Please see the BO Tax Return Form for a list of rates. Download the B O Tax form below.

Property tax sales tax and utility tax revenues. If this Tax Return is past due the following penalties must be included in your payment - minimum penalty 500 if tax is due. Businesses with gross receipts of 15 million or more per year earned within the City of Renton will be required to file and pay BO tax.

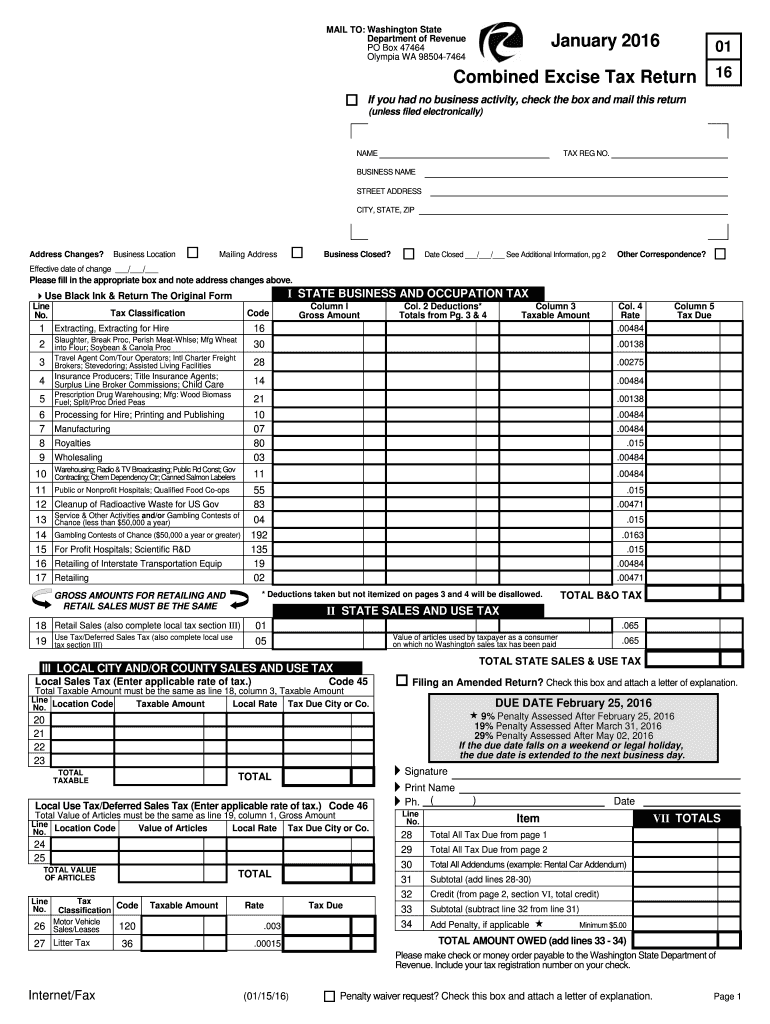

Mailing and payment instructions are on the Multi-Purpose Tax Return. In addition retail sales tax must also be collected on all sales subject to the retailing classification of the BO tax unless a specific retail sales tax deduction or exemption applies. The tax applies to the gross revenues of businesses at the rate of one-tenth of one percent except those.

As of January 1 2012 the Business Occupation BO Tax Rates have changed. The Citys B O Tax is based on the gross income gross receipts of each business. Local Business and Occupation Tax BO Yes Find your rates.

Annual Business and Occupation Tax Return Form PDF By the Job Business and Occupation Tax Return Form PDF. It is measured on the value of products gross proceeds of sales or gross income of the business. Businesses are subject to the BO tax if the annual taxable revenue is above the following thresholds.

Mail the form and payment to the City of Ruston 5117 N Winnifred Street Ruston WA 98407. For purposes of the BO tax business is defined as all businesses trades occupations and professions which offer any kind of service within Town. City of Bellingham Finance Department 210 Lottie.

Printing and scanning is no longer the best way to manage documents. Business License Tax Accountant. Complete and return the appropriate form below based on your businesss annual total gross revenue.

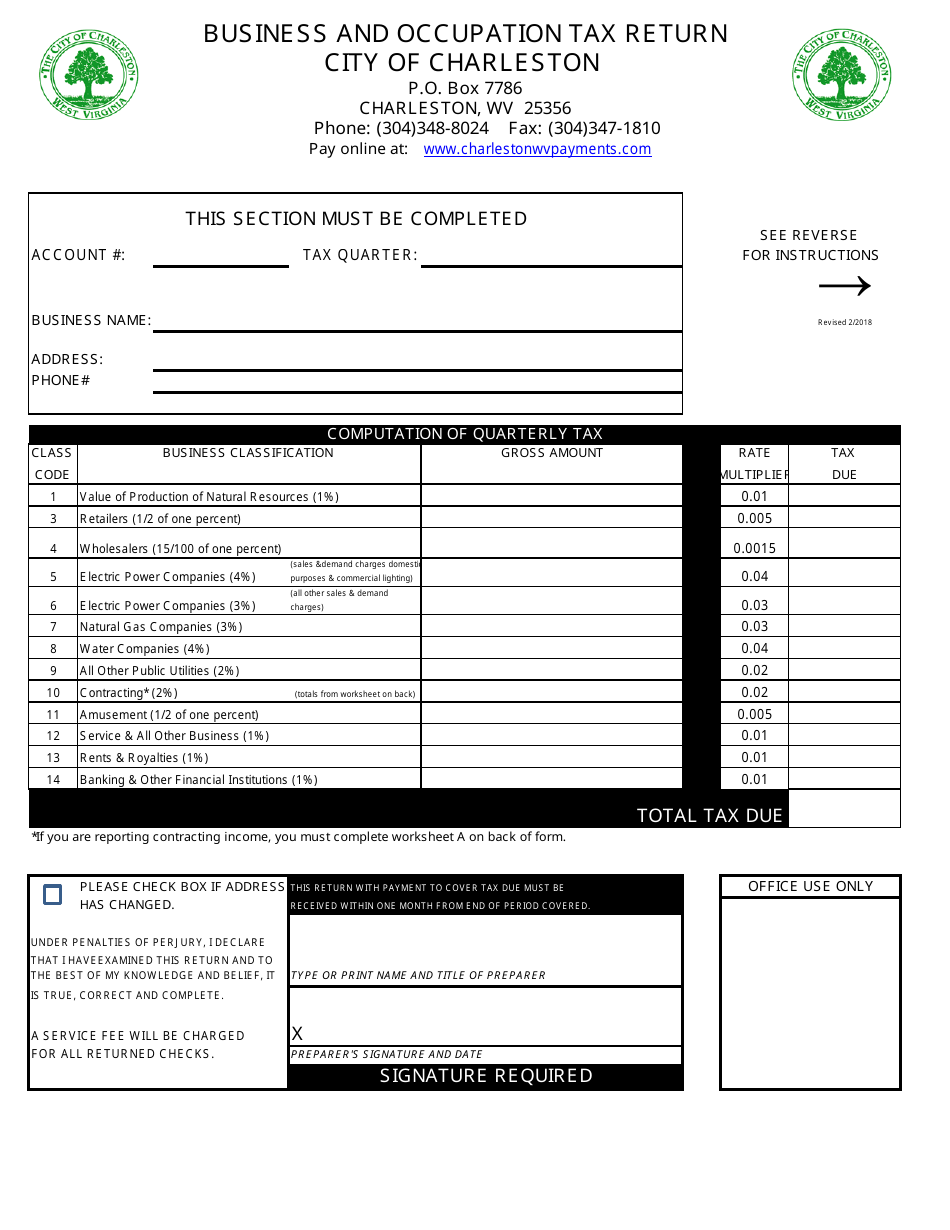

It is measured on the value of products gross proceeds of sale or gross income of the business. Business and Occupation Tax. Determine you Charleston BO taxable gross income for each of the classifications and enter it in the appropriate box.

Taxpayers can use forms available on this website to make application to the Finance Director. All taxes administered by Bellevue including the Business Occupation Tax and miscellaneous taxes such as utility admission and gambling taxes are reported on the Multi-Purpose Tax Return. Filing periods end on March 31 June 30 September 30 and December 31 unless other arrangements and.

Multiple business classifications can be filed. The four categories are as follows. Rental Property Registration Form.

Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Lacey was b o tax form online design them and quickly share them without jumping tabs. Gross Receipts Rents Royalties Etc. 001 or 1 Special Services BO Rate002 or 2.

29 of the tax due if not received on or before the last day of the second month following the due date. Washingtons BO tax is calculated on the gross income from activities. 2017 - 15 million.

Washington unlike many other states does not have an income tax. Codes forms and regulations. If you have any questions or cant find what you are looking for contact us at 304-599-5080.

City License and Tax Information. Stay up to code by following all our codes and regulations. Tax Period Select the tax period for which you are submitting this return.

The Citys General Fund provides for most day-to-day city services such as police services parks and recreation social services financial services community development street maintenance engineering services court jail services etc. This tax is collected from anyone conducting business within the corporate limits of the City of Martinsburg. Either by downloading a PDF and filling it out by hand or downloading the new B and O Tax Worksheet in Microsoft Excel to keep for your own records.

To submit your B O Tax Form follow these instructions. The City of Buriens share of the total sales tax is 085. Instructions for Completing Quarterly BO Tax Return 1.

Business and Occupation Tax Return Title 6 of the Tacoma Municipal Code as Amended. BO TAX CLASSIFICATIONS AND RATES VARY ACCORDING TO THE TYPE OF BUSINESS. Filing Frequency and Due Date.

CONTACT THE CITY OF WHEELING AT 304-234-3653 FOR ADDITIONAL INFORMATION. Find your sales tax rate. For more information please see the City of Renton Business and Occupation Tax Guide or Renton Municipal Code RMC.

A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. 2016 - 15 million. The City Business Occupation BO tax is a gross receipts tax.

See Codified Ordinances of the City of Wheeling Part 7 Chapter 5 Article 787. Beginning on July 1st of each fiscal year the City collects Business and Occupation BO Taxes. Determine your taxes due by multiplying the rate by the taxable income.

Timely Submission A return must be submitted within 30 days from the end of. Both Washington and Tacomas BO tax are calculated on the gross income from activities. This means there are no deductions from the BO tax for labor.

BO Tax Return Form. Businesses choose which way to submit Tax returns. New or Expanded Business and Job Creation Tax Credit.

There is no penalty on late returns with no tax due. The City of Tumwater collects and administers a local Business Occupation tax as authorized by Tumwater Municipal Code TMC Chapter 508. Washington unlike many other states does not have an income tax.

Contact the City Clerk for any questions or concerns at 253 759-3544. LESS MULTIPLE ACTIVITIES TAX CREDIT - MUST HAVE SUPPLEMENTAL FORM ATTACHED 31617 AVAILABLE AT CITYOFTACOMAORG LESS SMALL BUSINESS CREDIT 31858. Until January 1 2018 businesses under the threshold were also required to pay the per employee license fee.

We recommend that you open these PDFs with a PDF software. Businesses may be assigned a quarterly or annual reporting period depending on the tax amount or type of tax. The City collects revenues in the form of taxes to provide services to the community.

The Retailing BO tax rate is 0471 percent 00471 of your gross receipts. Visit the departments website for a copy of the MATC form. More information is available on the application and reporting forms or by calling the BO Tax Manager at 304-366-6212 ext.

PENALTIES Please provide the following information if there has been a sale or closure of your business during this tax period. Sign the form and mail in a check payment for the total taxes due by the Quarterly due date. Businesses that are required to pay BO tax do not pay the Per Employee Fee.

Check the box and enter the year. Contracting class instructions are listed below 3.

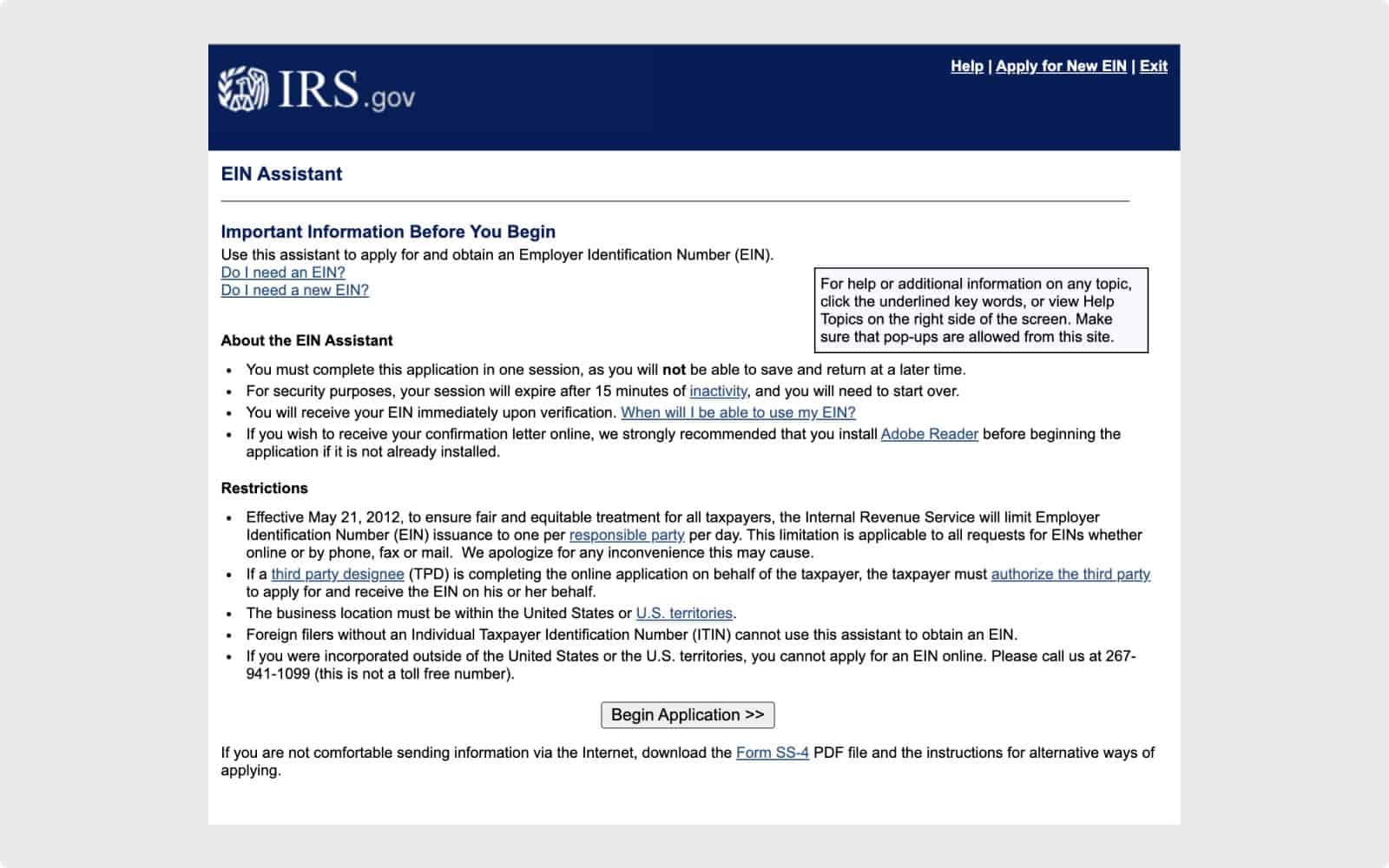

How To Get A Tax Id Number For An Llc Quick Guide Simplifyllc

Wa B O Tax Form Fill Online Printable Fillable Blank Pdffiller

How Can I Pay My Washington State B O Tax Destinationpackwood Com

Tacoma B O Tax Fill Online Printable Fillable Blank Pdffiller

When Are Washington S Business Occupation B O Taxes Due 2021 Youtube

Washington Combined Excise Tax Return Fill Out And Sign Printable Pdf Template Signnow

City Of Olympia B O Tax Form Fill Online Printable Fillable Blank Pdffiller

Tacoma B O Tax Fill Online Printable Fillable Blank Pdffiller

Wa Business Occupation Tax Return Tumwater Fill Out Tax Template Online Us Legal Forms

Tax Filing Example Washington Department Of Revenue

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

When Are Washington S Business Occupation B O Taxes Due 2021 Youtube

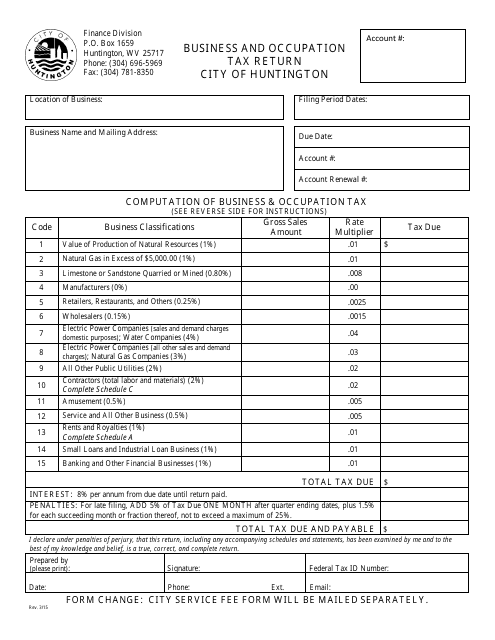

City Of Huntington West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller